请 更新浏览器.

小企业是地方经济的重要组成部分, 在2015-2016年期间, their growth was primarily driven by spending from younger and lower income consumers. 然而,在小企业增长方面存在重大的地区差异.

In 2014, the 美国人口调查局 reported that small businesses employed 48 percent of the US workforce, and separate research estimated that economic activity at small businesses accounted for 45 percent of US GDP in 2010.1, 2 同时,我们自己也在考察企业的流动性 现金为王:流量、余额和缓冲日 revealed that small businesses often exist in a state of financial vulnerability, with half of small businesses holding only enough cash to support just under a month of typical outflows.3 Vulnerability to short-term financial changes means that small businesses are particularly susceptible to changes in consumer spending. 为了更好地理解这种暴露, the 澳博官方网站app研究所 analyzed the differences in small business spending for different groups of consumers.

We find that younger and lower income consumers drove small business spending growth between 2015 and 2016 (see Figure 1).4 Growth increased in early 2015 for consumers younger than 35 and remained at high levels throughout 2016. 与此同时, 35岁至54岁消费者的消费增长相对平稳, 而对于55岁及以上的消费者则有所下降. 相比之下, spending growth at medium and large businesses declined across all age groups over the same time period.

关键的事实

- Younger and lower income consumers drove small business spending growth between 2015 and 2016.

- Small business spending growth is higher for younger consumers than older consumers; the growth rate gaps remains relatively stable over time.

- 各大城市的小企业支出差异很大.

图1:年轻消费者推动小企业支出增长.

类似的, Figure 2 shows that small business growth was highest for lower income 五分位数s over 2015-2016. 相比之下, growth in spending at medium and large businesses declined for all income 五分位数s during that time.

Figure 2: 小型企业 支出 Growth Was Primarily Driven By Lower Income Consumers.

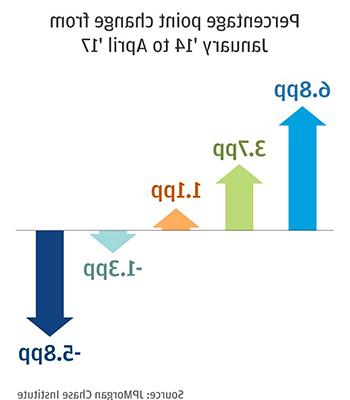

We further examined small business spending growth for each intersection of income and age, 如图3所示. Small business spending growth was highest for younger consumers in the bottom two income 五分位数s in 2015-2016. The relationship between age and small business spending differed from the relationship between income and small business spending. We saw that overall spending growth is lower for older consumers than younger consumers (even through early 2017), but the distance between growth rates for these groups remained relatively stable. 相比之下, spending growth declined faster over time for higher income consumers relative to lower income consumers throughout the 2015-2016 period. Figure 3 allows you to explore metro area trends and compare your own metro area with others in our set.

图3:年轻人, 低收入消费者推动小企业支出增长, 当老, 高收入消费者拖累经济增长.

The overall trend informs the general state of small business growth in metropolitan areas across the US, 但在特定的大都市地区,消费模式有所不同.

Figure 4 displays the overall small business trend (via the dashed blue line) bounded by the minimum and maximum growth among our 15 metro areas in each month. 上图描绘了收入最低的五分之一中35岁以下的消费者, 下图描绘的是收入最高的五分之一中55岁及以上的消费者. These two groups represent the extreme ends of the income and age distributions, 哪一点突出了它们对小企业增长的影响. While the overall trend in small business spending growth was generally consistent across the 15 metro areas we study, there was material variation in the level and sometimes even the direction of small business growth between different metro areas.

图4:小企业支出增长存在地区差异.

Small businesses are an important component in determining the vibrancy and health of economies. Understanding which groups of consumers are patronizing these small businesses provides decision makers and business owners with vital information regarding their consumer base. The JPMC data provide an unprecedented view of the real economic activity happening at businesses within the 15 metropolitan areas we track, providing vital information that can better inform economic analysis and policymaking for the public good.

建议引用

法瑞尔,戴安娜和布莱恩·金. “年轻和低收入的消费者推动了小企业的支出.澳博官方网站app研究所.

此分析使用本地消费者商务(LCC)数据资产, which encompasses over 20 billion de-identified credit and debit card transactions from over 60 million consumers in 15 major metropolitan areas. LCC指数, 建立在LCC资产之上, captures year-over-year growth in everyday spending across a 范围 of consumer and merchant groups. The transaction-level data in the LCC data asset are augmented by the zip codes of both the consumer and merchant, 提供本地, 基于地方的支出增长观点. Consequently, we can evaluate trends at both the city level and across the 15 cities we track.